India’s efforts in grassroots finance have been dominated by a powerful form of savings and loan clubs. Self-Help Groups, or SHGs as they are called, nudge urban and rural poor women and men to save small amounts of money. They then borrow pooled money to meet household and livelihood needs. Since the early 1990s, the National Bank of Agriculture and Rural Development (NABARD) has promoted an SHGs bank-linkage program. SHGs tap bank credit to augment the funds they have accumulated on their own, allowing members to reclaim lost land, start new enterprises, or build roads and schools. More recently NABARD is helping groups to save funds in banks. While the linkage effort is reaching tens of millions of people, it has not addressed many issues of unmarried women, migrating men and women, or ultra-vulnerable households. This paper proposes that NABARD investigate a share-based system, called Community Based Savings Groups, where SHGs can reach and accommodate households thus far blocked from membership.

Turning Cold Money Hot

August 2013

ASSOCIATED PROJECT

SUBJECTS

PUBLICATION TYPE

LOCATION

RELATED PUBLICATIONS

The time pressure involved in designing and implementing anticipatory action can discourage the localization of decision-making. Learn more from a cartoon-infused summary of insights.

•

July 2024

Early Warning Systems can reduce deaths and damages caused by extreme weather events, if investors address gaps in communication and planning. Learn more from a cartoon-infused summary of insights.

•

July 2024

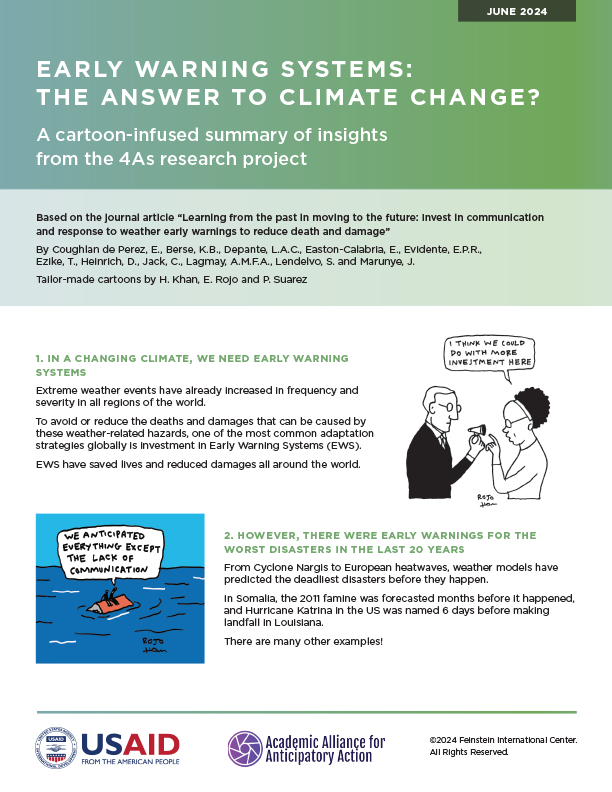

This synthesis report reflects upon Phase 1 findings on humanitarian action in pastoral drylands of the Greater Horn and Sudano-Sahel.

•

June 2024

This desk study examines common perceptions of pastoralism among humanitarians and barriers to international humanitarian systems meeting pastoralists’ needs.

•

June 2024

This desk study explores how state-owned policies and programs in pastoral areas of the Sudano-Sahel and the Greater Horn of Africa meet pastoralists’ needs and priorities.

•

June 2024

This desk study explores how pastoralists manage climate, conflict, and other stresses through indigenous early warning systems, preventive actions, local emergency responses, and customary safety nets.

•

June 2024